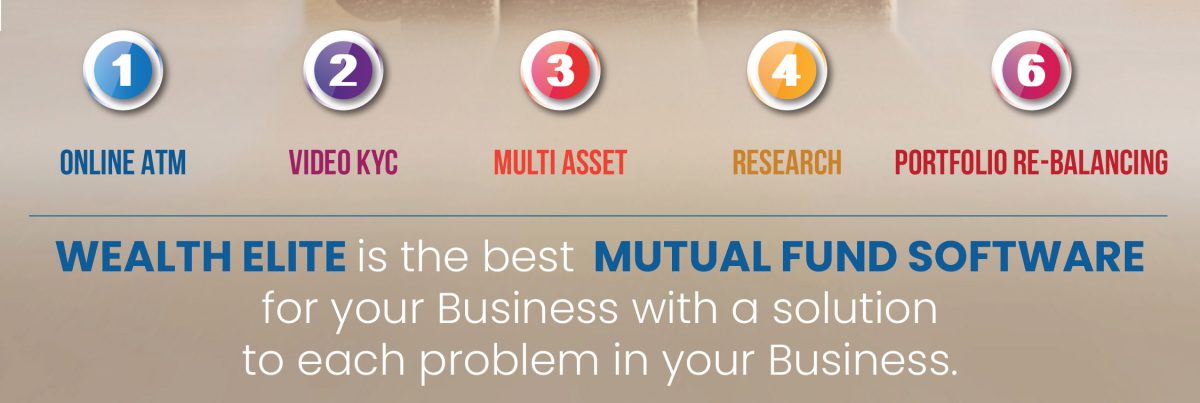

The advisors functions are unlimited while handling the portfolios of multiple clients and not easy to deliver high returns on each portfolio without any assistance. The advisors need a technology which is capable to perform tasks on behalf of the advisors and smoothly operate the management of the business. The REDVision Technology has introduced Mutual Fund Software for IFA which boosts the performance of the portfolio in order to earn lucrative returns.

Benefits of software:

- Goal based investment for better results.

- Improves business transactions and productivity.

- Several report generation for tracking status.

- Anytime access from any device.

- Highly advance features for complex issues.

Issues without having software:

- No data management.

- Difficult to serve each client.

- No goal based investment or planning.

- Typical to retain clients for long term.

- High cost of transactions.

The platform is essential for every business and advisors to exist for long term in the market and to compete with the rival firms. Those businesses have maximum chances of getting success which have adopted software for accomplishing back operations of the business and also are doing well along with setting benchmarks in the industry.

For more information, visit @-https://www.redvisiontech.com/

You must be logged in to post a comment.